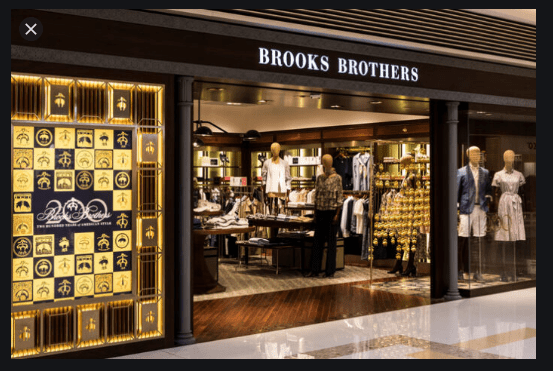

Brooks Brothers Credit Card: Brooks Brothers is the oldest men’s clothier in the United States. The company has introduced many clothing novelties to the American market throughout its history as a leader in the American menswear industry. They also produce women’s clothing. We will take a look at how you can complete your Brooks Brothers Credit Card Login as well as other information you will need to know about this card.

To facilitate their transactions and make things easier for their customers, Brooks Brothers is offering a Credit Card to all its customers. This card comes with no annual fee and requires an average-excellent credit score for approval.

The Card attracts a lot of rewards such as 15% off on Brooks Brothers purchases for 1 month, $20 Brooks Brothers MasterCard First Purchase Reward, $20 annual birthday reward and access to exclusive cardholders events.

You can easily manage your account online and earn 1 point per 1 dollar spent on purchases outside of Brooks Brothers. This Card also enables you to get cash access from ATMs and comes with zero fraud liability. Its MasterCard Assist Benefits includes Extended Warranty, Price Protection (60 days); and Identity Theft Resolution.

Brooks Brothers Credit Card is issued by Citibank. Check out the fees/rates and follow the steps below to apply for your Credit Card. This is one of the greatest cards out there.

Brooks Brothers Credit Card Fees/Rates

- Annual Fee – None Charged

- Intro APR Rate – N/A

- APR Rate –49%-22.49% (Variable)

- Cash Advance APR Rate –49%, Variable. Subject to change.

Did you miss our article on the torrid credit card log in Check it out here?

How to Apply for Brooks Brothers Credit Card

- Visit the homepage of the Brooks Brothers Platinum MasterCard credit card page from your browser.

- Type in the following personal information; First name, Middle name, Last name, Email address (user@domain.com), Address (Street address), Phone ( Primary phone number), Financial information ( Residence, payment & status income, SSN, DOB (MM/DD/YYYY.

- Read the account terms and details, and agree to them.

- Click the “Submit” button, to submit your application for approval.

How to Activate and Register Brooks Brothers Credit Card

If your application was successful and approved, you will receive the Credit Card. After that, you need to activate your newly acquired Brooks Brothers Platinum MasterCard online through the steps below:

- Visit the homepage as in the first step above.

- Sign in to your existing account with your user ID and Password, and tap on the ”Sign On” button situated just beneath the password box.

- Tap on the “Register Your Card”

- Fill out your card number, your name as it appears on your card, security code, and the last 4 digits of the primary card holder’s SSN, and tap on the “Verify” button, the Security code is the CVV number (three digits) which you should have on your card.

- You alternatively sign-on, using a quick link at the bottom of the home page of the store’s site – “My Credit Card Account”.

Brooks Brothers Credit Card Login | How to Login

Subsequently, can log in or carry out your Brooks Brothers credit card sign in to your credit card account through the following steps:

- Scroll to the Brooks Brothers Credit Card Login page of Brooks Brothers Platinum MasterCard homepage

- Enter your User ID in the field provided

- Tick on the “Remember My User ID” box (optional)

- Enter your Password, to enable you to log in.

In case you forget your Username, you can recover it using this link: https://online.citi.com/US/JSO/uidn/RequestUserIDReminder.do

We recently talked about how to apply to capital one credit card. Check it out

Brooks Brothers Credit Card Payment: How to Make Brooks Brothers Bill Payment

Payment By Mail

You can send your bill payment to the following address:

Brooks Brothers Platinum MasterCard® Payments

P.O. Box 9001006

Louisville, KY 40290-1006

Brooks Brothers Platinum MasterCard® Overnight Delivery/Express Payments

ATTN: Consumer Payment Dept

6716 Grade Lane

Building 9, Suite 910

Louisville, KY 40213.

Phone Payment

Call at 1-888-274-3777, and provide your card number and checking account number.

We recently talked about Airbnb login.

Online Payment

- Sign in to your account

- Scroll to the payment section

- Choose a suitable payment option, and make your bill payment.

Brooks Brothers Credit Card Phone Number | Brooks Brothers Credit Card Customer Service Number

For inquiries, call 1-800-347-4934, 1-888-766-2484, 1-866-458-4271, to gain access to a customer service agent.

READ ALSO: Norm Thompson Credit Card Login

Tips about Brooks Brothers Credit Card

More Benefits

Being a co-branded card, Brooks’ Brother credit card gives you an amazing offer that is different from anything else in the market. You get 15% off the purchase for the first day of your using this card.

The platinum MasterCard version of the Brooks brother card grants you access to more 15% for one month after your Mailing.

You get a further $20 reward when you use the card to make any purchase in the first 60 days.

Continues Reward Program

The Brooks Brother Platinum MasterCard avails you the privilege of getting 4 to 6 points for any $1 spent with Brooks Brother’s store and 1 Point when you use the card elsewhere. Every 1000 points amount to $10 that can be used at any of Brooks Brother’s store. So every point means a lot. You can as well redeem your point online or via phone

Higher Spenders Get More Rewards

The more you spend, the more you earn more reward yourself while using this card. IF you can spend up to $750 in a singular year, you will be entitled to 5 point reward for any $1 spent.

Those that could spend up to $1500 in a year, get 6 point reward for any dollar spent using the card. Once you get to the loyalty level, you retail the status for the rest of the year.

Perks For Insider Could Be Added Value

Cardholders get a few premium perks.

- Birthday: You can get a $20 birthday reward if you can use the card at least once in a year.

- You get free return shipping in the US on a web or phone product offer.

- You can get only cardholder event

- You will be getting extra special event sales and promotion notifications.

Try Not to Carry A Balance

You could get higher finance charges than your reward when you carry a balance using this card. The present APR is 16.24% – 23.24% variable APR.

I will advise you not to carry a balance with brooks’ card.

Social Media: Facebook, Twitter, Wikipedia, Pinterest